Tax Notices & Bill Information

Tax Assessment

The tax year begins January 1 and ends December 31 of the current year. Tax Notices are sent at the beginning of July and taxes are due October 31 of the tax year. Tax levy information is available to the public by calling the Town of White City 306-781-2355. We currently do not publish property levy values on our website.

Taxes begin with property assessments. Assessments are completed by the Saskatchewan Assessment Management Agency on behalf of the Town of White City. For more information on property assessments, please click here.

Assessment Notices are mailed out in the spring to all properties unless the assessed value of a property:

- has not changed from the previous year’s assessed value; or

- the increase or decrease in assessed value does not exceed the lesser of:

- $1,000 from the previous year’s assessed value; and

- 1% of the previous year’s assessed value.

When the assessment roll is opened, any resident may request an assessment notice for their property. Property owners are given 30 days, or 60 days in a revaluation year, to appeal their property assessment.

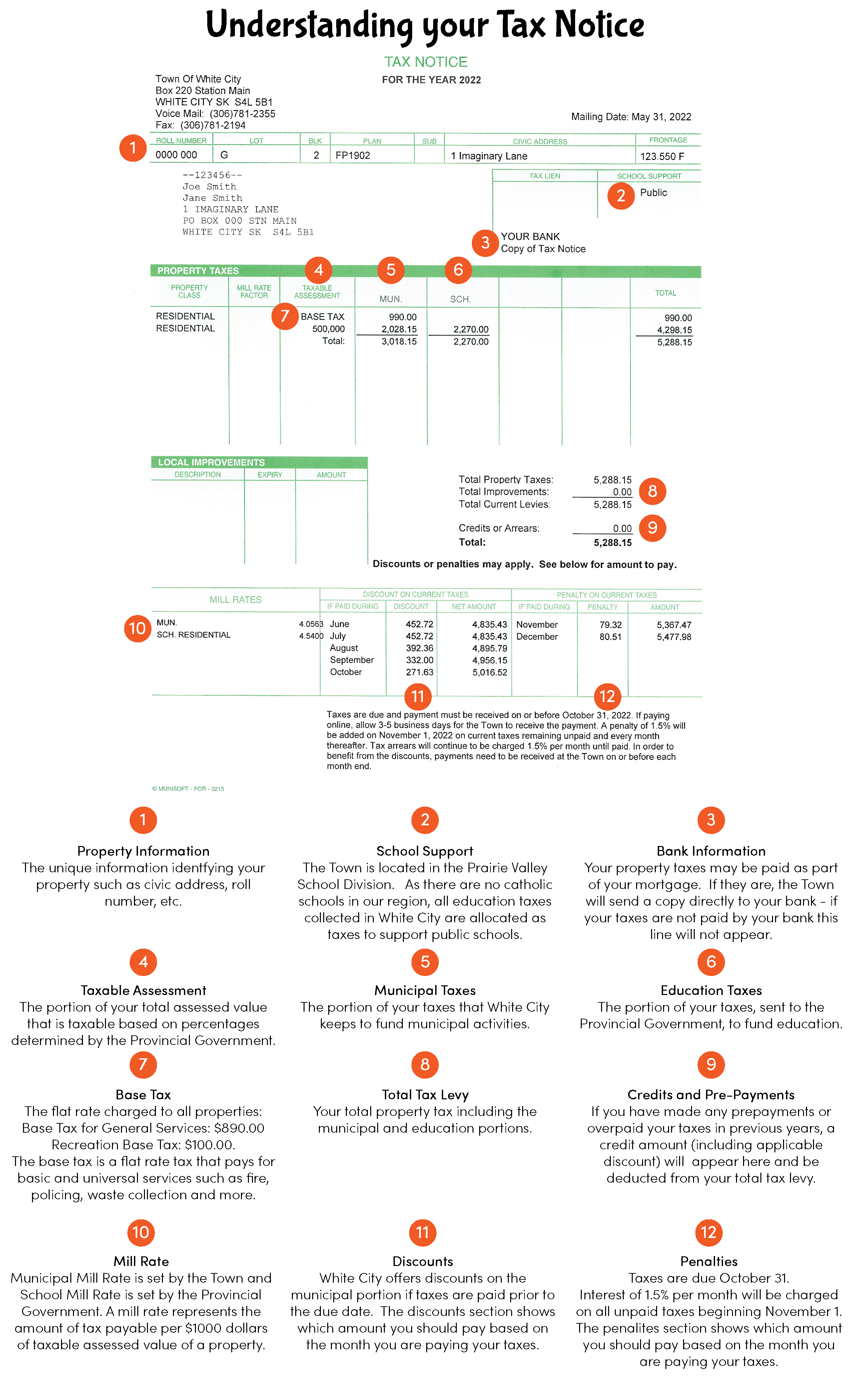

Assessment value is the value which the taxable assessment of properties comes from. Currently, the taxable value for residential properties is 80% of the assessment value. The taxable value is then multiplied by the mill rate and divided by 1000 and added to the base tax to calculate the municipal portion of taxes. The Education tax is calculated the same way as the municipal tax using the School mill rates and removing the Base Tax.

Example: (Assessed Value x 0.80 x Mill Rates) / 1000 + Base Tax = Municipal Portion of Taxes

(Discount would be applied to the Municipal Portion of Taxes based on the discount schedule shown below)

Example: (Assessed Value x 0.80 x Education Mill Rates) / 1000 = Education Portion of Taxes

TAX RATES

2026 TAX INFORMATION

| Municipal Mill Rates | 2025 Education Mill Rates (2026 Rates TBD) | ||

| Residential: | 3.8043 | Residential: | 4.2700 |

| Commercial: | 3.8043 | Commercial: | 6.3700 |

Base Tax

| Developed Base Tax: | $1,390.00 | Undeveloped Base Tax: | $1,110.00 |

| - General Portion | $1,290.00 | - General Portion | $1010.00 |

| - Recreation Portion | $100.00 | - Recreation Portion | $100.00 |

Levy And Notices

Tax discounts apply as follows to the municipal portion, (but not on the education portion):

15% if paid by July 31st

13% if paid by August 31st

11% if paid by September 30th

9% if paid by October 31st

Taxes are due October 31. Payment must be received on or before October 31.

If paying online allow 3-5 business days for the Town to receive the payment. A penalty of 1.5% will be added on November 1 on current taxes remaining unpaid and every month thereafter. Tax arrears will continue to be charged 1.5% per month until paid.

Tax Payment Options

- The Town accepts Online Banking Payments. Please follow these steps to set up the Town through your online banking institution:

1. Add Payee or Vendor

2. Search for “White City”

3. Select the appropriate account > Utility or Taxes

4. Enter your Roll Number as it appears on your Tax Notice.

Online payments can take up to 3 business days to be processed by our bank, please allow plenty of time before the due date to avoid interest fees.

- The Tax Installment Payment Program (TIPP) provides property owners with the opportunity to make 12 consecutive monthly property tax payments as opposed to a single, annual payment, making it easier to budget and eliminating the risk of late payments. Payments can only be made by automatic withdrawals from a bank account on the 1st of each month. Check out the TIPP webpage for more information and the application form.

- The Town accepts Credit Cards (Visa and MasterCard) using OptionPay that can be used online or through the Town Office. OptionPay uses a tiered fee schedule, check out OptionPay for more information. Payments using an online service take 3 business days to process, please allow plenty of time before the due date to avoid interest fees.

- The Town accepts Cash, Cheque, or Debit at the Town Office. We are open from 8:00 a.m. to 5:00 p.m. Monday to Friday. If you are unable to come during these hours there is a mail chute you can leave your cheque in, please leave it in an envelope with your name, account number, and civic address so the payment can be properly applied.

Tax Information

Tax levy information is available to the public by calling the Town of White City 306-781-2355. We currently do not publish property levy values on our website. If you’d like to obtain property tax information for any property within the Town of White City, you may request a tax certificate.

A tax certificate will provide you with:

- the amount of taxes levied and still owing;

- the total amount of arrears;

- the amount of any current or proposed local improvements attached to the property;

- whether an assessment appeal is outstanding; and

- whether there are outstanding amounts that may be added as a result of an order to remedy a condition of the property.

Per the Town of White City’s Fee Bylaw, a tax certificate is $25 per property and can be paid by cash, cheque, or debit at the Town Office or by mail with cheque. Requests for tax certificates must be made in writing, by email or mail, and clearly identify the requested property by civic address and legal land location. When sending a tax certificate request by email, the image of the cheque for payment must be attached; an unofficial tax certificate will then be emailed back to you and the original will follow by mail once payment has been received.

If you are the property owner and you’d like an update on the balance of your property tax account, please call the Town Office at (306) 781-2355.